In the dynamic world of financial services, the demand for robust data analysis and innovative problem-solving is paramount. As a financial journalist with a focus on the intersection of technology and finance, I’ve witnessed firsthand the transformative power of Python programming within this arena.

In the dynamic world of financial services, the demand for robust data analysis and innovative problem-solving is paramount. As a financial journalist with a focus on the intersection of technology and finance, I’ve witnessed firsthand the transformative power of Python programming within this arena.

Fintech companies and industries at large are tapping into Python’s potent capabilities to navigate the complexities of big data and the sophisticated exigencies of data science. The adaptability of Python in financial services not only automates mundane tasks but also makes strides with machine learning algorithms that redefine predictive analytics.

The burgeoning fintech sector relies heavily on software development to elevate their operations, and Python emerges as a linchpin in this developmental journey.

By serving an array of applications—from crunching numbers to crafting algorithms that outsmart market volatility—Python programming underpins the strategies that nudge fintech companies ahead in a cutthroat market.

Let’s explore how this versatile language is catalyzing growth and innovation in fintech industries.

Key Takeaways

- Python’s simplicity and flexibility make it ideal for fintech’s fast-paced environment.

- Financial services are leveraging Python for both data analysis and machine learning applications.

- Python programming serves as a cornerstone for software development, shaping the fintech landscape.

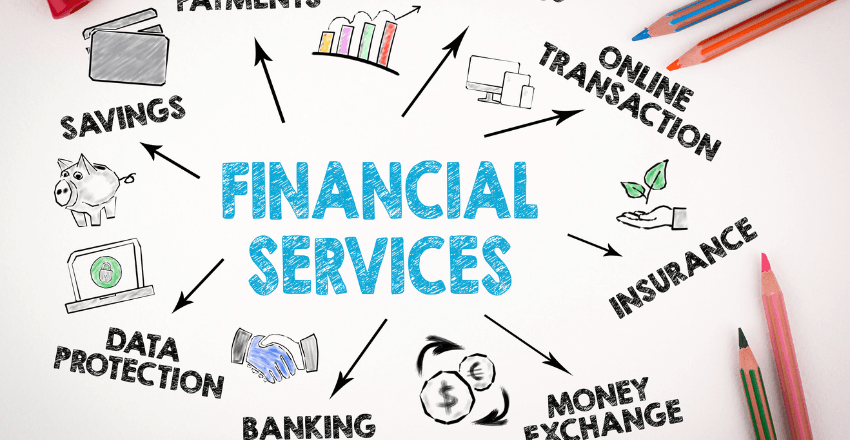

The Fintech Revolution: Python’s Role in Reshaping Financial Services

In my exploration of the finance industry’s evolution, it’s evident that the fintech revolution is redefining the way we interact with financial services. It’s fascinating to note that the driving force behind many of these changes is the programming language, Python. Let’s delve deeper into this phenomenon and unpack Python’s substantial impact.

Understanding the Fintech Landscape and Python’s Place Within It

As I navigate the fintech landscape, it becomes clear that Python has carved out a significant niche for itself. The language’s simplicity and extensive libraries make it an ideal choice for a range of financial applications.

Python for fintech is more than just a buzzword; it’s the backbone of numerous fintech solutions, simplifying complex financial computation and analysis. Python developers are in high demand, as fintech firms seek to leverage this versatile programming language to gain a competitive edge in the rapidly evolving fintech market.

Python in Financial Services in Key Applications

- Stock Market Analysis: Python is used to analyze stock market volatility, utilizing statistical methods and the GARCH model to study the impact of stock index futures on market volatility (Meng, Song, Qin, & Song, 2021).

- Financial Data Analysis and Forecasting: It plays a critical role in data analysis, stock market forecasting, and predicting stock prices. Python’s capabilities in handling and processing large datasets make it ideal for financial data analysis and risk quantification (Aggarwal & Khanna, 2021), (Yu, 2021).

- Trading Strategy Development: Python is extensively used for analyzing financial markets, developing trading strategies, and implementing backtests for trend following strategies. This includes market-consistent valuation, hedging, and advanced data analytics like risk-neutral valuation and Monte Carlo simulation (Amen, 2017), (Hilpisch, 2015).

- Web Scraping for Financial Data: Python is also utilized for web scraping, efficiently extracting financial data such as balance sheets, income statements, and cash flows from platforms like Yahoo Finance for presentation in Excel sheets, enhancing productivity for business analysts (Chanda & A, 2020).

- Cyber Threat Detection in Financial Services: It aids in developing predictive models to detect and prevent suspicious customers with cyber threat potential, especially in mobile money services in developing nations (Sanni, Akinyemi, Olalere, Olajubu, & Aderounmu, 2023).

- Machine Learning in Stock Forecasting: Python’s machine learning capabilities are used to build models for predicting stock prices, reducing the impact of stock market disasters on the economy (Hao, 2022).

- Financial Education and Teaching: Python notebooks are a key tool in teaching cash management in business education, demonstrating its role in educational settings for financial applications (Salas-Molina & Pla-Santamaria, 2018).

- Integration with Big Data and Parallel Computing: Python integrates with big data systems and supports parallel computing, significantly improving the efficiency and execution time for large-scale financial applications (Zhang, Gao, & Shi, 2018).

How Python is Fueling Innovation in the Finance Sector

Through my in-depth research and interviews with industry insiders, it’s clear that Python is not just maintaining the status quo—it’s pushing boundaries.

Fintech projects harnessing Python are leading the charge in innovation, from streamlining customer services through chatbots to utilizing machine learning algorithms for investment strategies. Python provides the tools necessary for developers to build forward-thinking solutions that respond to the modern challenges of the finance industry.

Why Python in Financial Services Is a Game Changer

In the rapidly advancing realm of fintech development, the introduction of Python into finance has been revolutionary. Python’s ascendancy is one of the clearest signals of transformation within the industry.

Its usage spans across numerous applications that are essential to the sector, providing advantages of Python that seasoned developers and financial experts alike can appreciate. The choice to use Python for fintech purposes is not incidental; it is underpinned by the language’s intrinsic traits that align impeccably with the needs of finance and fintech sectors.

Why do companies choose Python for fintech? The answer lies in both its simplicity and the efficacy it provides. Python facilitates swifter development cycles, an invaluable advantage considering the dynamic nature of financial markets.

Fintech applications, complex financial models, and real-time transaction processing are but a few instances of where Python is used. An advantage of using Python includes its readable and concise syntax, which fosters better cooperation among development teams, expedites the introduction of new financial products, and importantly, reduces the likelihood of costly errors.

Moreover, as we venture further into the era of big data, Python’s ability to manage vast datasets becomes ever more critical.

The rich repository of Python libraries dedicated to data analysis and scientific computing makes it uniquely capable of handling the intricate and voluminous data inherent in the financial sector. This makes Python not just a participant in the fintech arena but a substantial force – Python is powering the fintech revolution.

- Fintech efficiency gains

- Strategic agility and nimbleness in product development

- Inter-team collaboration enhancements

- Accuracy and dependability in financial calculations

Python in finance is more than just a tool; it is the very bedrock upon which companies are constructing their future. By embracing Python, the fintech industry is achieving elevated levels of performance, which in turn is driving growth, innovation, and security in financial services. The continued adoption of Python in this field is a testament to its status as an essential asset in any fintech venture’s arsenal.

Python in Financial Services: Building Sophisticated Fintech Solutions

The integration of Python into financial services has been instrumental in constructing advanced fintech solutions that effectively manage and interpret complex financial data.

Through my exploration and analysis, the ingenuity of Python’s libraries has proven to be a significant asset for data-driven financial strategies. Python stands at the forefront of the intersection between finance and technology, propelling the industry towards unprecedented efficiency and innovation.

Navigating Financial Data with Python’s Libraries and Packages

Gone are the days of tedious data manipulation and analysis, thanks to Python’s powerful libraries like NumPy and Pandas. These resources have been pivotal in my experiences with building a fintech foundation from the ground up.

Their effectiveness in handling extensive datasets allows for sophisticated data visualization, which is a crucial element in understanding financial trends and market behaviors. The prowess of Python libraries has redefined how professionals approach financial data, granting the industry unparalleled clarity and precision in its operations.

Developing Cutting-Edge Fintech Applications with Python

Creating software solutions that stand up to the complexities of the finance world requires a robust programming foundation. My foray into this technological domain has shown that Python’s dynamic environment fosters the development of innovative fintech applications.

Python’s versatility is apparent in its real-time processing capacities and decision-making enhancements, which are vital to building a competitive fintech enterprise. The ability of Python to seamlessly integrate into various financial operations propels its status as an indispensable tool in the development of fintech software.

Best Python Libraries for Fintech Development and Their Advantages

In the fast-evolving world of fintech development, identifying the best Python libraries is imperative for success. These libraries not only streamline data analysis tools but are also pivotal in building a fintech solution that offers sophisticated and agile responses to the market.

My comprehensive analysis introduces industry-standard Python libraries that significantly contribute to various domains, including stock trading, quantitative finance, and the broader scope of fintech product innovation.

Empowering Data Analysis and Visualization in Fintech with Python Tools

In fintech development, data is king. Libraries such as Matplotlib and Seaborn are my top picks for transforming quantitative data into qualitative insights. These tools have proven essential in visualizing complex financial data streams, enabling analysts and stakeholders alike to interpret market conditions with greater clarity.

The ability to present financial intelligence through comprehensive visuals is not merely convenient; it’s essential for informed stock trading and investment decisions.

Leveraging Machine Learning for Predictive Finance with Python Libraries

When it comes to anticipating market trends and customer behaviors, machine learning stands out. Python’s Scikit-learn library is my go-to for developing robust predictive models.

The library’s comprehensive set of algorithms allows for the effective training, testing, and deployment of machine learning models, which are central to the modern fintech product and service design. These capabilities facilitate the predictive prowess necessary for strategic financial planning and risk management within the realm of fintech development.

Quantitative Finance: Python Frameworks for Complex Financial Modeling

For those deeply engrossed in the quantitative finance sector, Python’s QuantLib library offers a versatile toolkit for pricing, modeling, and analyzing a wide array of complex financial instruments. The framework is instrumental in my analytical processes, providing a structured approach to derivative and risk analysis, which is invaluable in today’s volatile financial landscape.

QuantLib embodies the intricate requirements of building fintech infrastructure capable of sophisticated, real-time decision-making—underscoring Python’s role in building a fintech solution for an unpredictable market.

From Python Developers to Fintech Giants: Who’s Using Python Today?

I’ve seen the landscape of financial technology transform dramatically, and a notable aspect of this transformation is the widespread use of Python in the sector. Businesses of all sizes, from pioneering fintech startups to established global fintech corporations, have turned to Python for its scalability and efficiency.

The burgeoning dependency on Python is not coincidental; it’s the result of the language’s proven flexibility and capacity for building fintech solutions that meet the intricate demands of financial markets.

Through my professional observation, it’s apparent that companies using Python range from fintech businesses indulging in the creation of cutting-edge applications to traditional financial institutions seeking to modernize their operations.

The solutions written in Python deliver high performance and can handle the strenuous tasks of data analysis, predictive model building, and real-time financial processing. The agility and solid security framework of Python software make it a trusted ally in finance and fintech arenas.

Notably, dedicated Python engineers are at the core of this technological revolution, skillfully crafting Python code that underpins the infrastructures of contemporary fintech entities.

But the narrative doesn’t stop there; its characters are diverse, and the plot extends beyond the realm of skilled programmers. Large-scale finance and fintech industries now recognize the strategic advantage of nurturing dedicated Python engineers within their workforce.

External Resources

Analysis of Stock Market Volatility Based on Python by Meng, Song, Qin, & Song (2021): https://consensus.app/papers/analysis-stock-market-volatility-based-python-meng/02ec58baea375ad6a2b2d6ce86ad055f/

Investing Finance Analysis by Aggarwal & Khanna (2021): https://consensus.app/papers/investing-finance-analysis-aggarwal/74c4b4351c4759a68d4752f1d70d7574/

Using Python to Analyse Financial Markets by Saeed Amen (2017): https://consensus.app/papers/using-python-analyse-financial-markets-amen/cc8ff8859ea551a0bf0dac7dc4d1b394/

Financial data analysis and risk quantification based on Python by Gaohan Yu (2021): https://consensus.app/papers/financial-data-analysis-risk-quantification-based-python-yu/aafcfd6d98885b1aa61ad9edbe46babe/

Web Scraping in Finance using Python by Siddhant Vinayak Chanda & Arivoli A (2020): https://consensus.app/papers/scraping-finance-using-python-chanda/ed8a19502fd4511f88e3472d8288ce2a/

A Predictive Cyber Threat Model for Mobile Money Services by Sanni, Akinyemi, Olalere, Olajubu, & Aderounmu (2023): https://consensus.app/papers/cyber-threat-model-mobile-money-services-sanni/b5e2dff6a0665ad1ad03a7c4385c67d5/

Research on the Prediction Effect of Stock Closing Prices Based on Machine Learning by Zimeng Hao (2022): https://consensus.app/papers/research-prediction-effect-stock-closing-prices-based-hao/41cfcb12c7d45005a21de784dfa21695/

Aprendizaje orientado a la programación en economía, negocios y finanzas by Francisco Salas-Molina & David Pla-Santamaria (2018): https://consensus.app/papers/aprendizaje-orientado-programación-negocios-finanzas-salasmolina/217e491f95cd53adb9bc47c6f73bd2a9/

QuantCloud: A Software with Automated Parallel Python for Quantitative Finance Applications by P. Zhang, Yu-Xiang Gao, & Xiang Shi (2018): https://consensus.app/papers/quantcloud-software-automated-parallel-python-zhang/668f71a9d0ef5451a048cae292cf0459/

FAQ

Why is Python considered essential in fintech?

Python is essential in fintech because it has an easy-to-understand syntax, broad library ecosystem, and strong support for data analysis and machine learning, making it ideal for processing and analyzing large volumes of financial data. Its versatility and efficiency in software development help fintech companies innovate and scale their solutions effectively.

How are fintech companies using Python?

Fintech companies use Python to automate tasks, analyze financial data, create predictive models with machine learning, manage customer data, detect fraud, and build scalable financial services applications. Python’s flexibility makes it compatible with a vast array of fintech needs, from back-end processing to user-facing applications.

What makes Python stand out compared to other programming languages in finance?

Python stands out because of its readability and simplicity, which leads to faster development cycles and easier maintenance. Python also boasts a rich set of libraries and frameworks specifically designed for data science, machine learning, and financial modeling, making it particularly well-suited for the complexities of the finance sector.

What are some popular Python libraries used in fintech?

Some popular Python libraries in fintech include NumPy and pandas for data manipulation, Matplotlib and Seaborn for data visualization, Scikit-learn for machine learning tasks, and QuantLib for quantitative finance. These libraries provide essential tools for analyzing financial data, visualizing trends, and constructing complex financial models.

Can Python be used for building sophisticated fintech solutions?

Absolutely, Python is used to build sophisticated fintech solutions. It can handle complex financial data and allows developers to create advanced applications with features like real-time analytics, machine learning-based predictions, secure transactions, and custom financial models, all of which are fundamental to modern fintech products.

Why do startups and established companies choose Python for their fintech products?

Startups and established companies choose Python for its fast development speed, powerful data handling capabilities, and the support of a vast community. Using Python enables them to quickly launch reliable, scalable, and maintainable fintech products that can keep pace with the rapid changes in the financial industry.

How does Python aid in data analysis and visualization in finance?

Python aids in data analysis and visualization through libraries like pandas, which simplifies data exploration and manipulation, and Matplotlib and Seaborn, which help create insightful visualizations. These tools empower financial analysts and data scientists to interpret complex datasets and derive meaningful insights for decision-making.

What role does Python play in quantitative finance and complex financial modeling?

Python plays a significant role in quantitative finance and complex financial modeling through libraries such as QuantLib, which allow for the construction and analysis of sophisticated financial instruments. Python’s capabilities enable quants to perform tasks ranging from derivative pricing to risk management and to develop trading strategies based on robust quantitative models.

Are there any real-world examples of fintech solutions powered by Python?

Yes, there are many real-world examples of fintech solutions powered by Python. Companies like Stripe, Robinhood, and Square utilize Python to build payment systems, stock trading platforms, and other financial services, benefiting from its robust backend and data processing capabilities.

What advantages do fintech developers gain by using Python?

Fintech developers gain several advantages by using Python, including increased productivity due to its simplicity, access to a vast ecosystem of libraries for data science and finance, and the ability to build and deploy applications quickly. Python’s dynamic nature also allows for easy experimentation and iteration—a critical factor in the innovative fintech industry.

Lydia is a seasoned technical author, well-versed in the intricacies of software development and a dedicated practitioner of Python. With a career spanning 16 years, Lydia has made significant contributions as a programmer and scrum master at renowned companies such as Thompsons, Deloit, and The GAP, where they have been instrumental in delivering successful projects.

A proud alumnus of Duke University, Lydia pursued a degree in Computer Science, solidifying their academic foundation. At Duke, they gained a comprehensive understanding of computer systems, algorithms, and programming languages, which paved the way for their career in the ever-evolving field of software development.

As a technical author, Lydia remains committed to fostering knowledge sharing and promoting the growth of the computer science community. Their dedication to Python development, coupled with their expertise as a programmer and scrum master, positions them as a trusted source of guidance and insight. Through their publications and engagements, Lydia continues to inspire and empower fellow technologists, leaving an indelible mark on the world of scientific computer science.